There may also be service fees during the time the factoring company works with you. The amount deducted from your invoice value is a factor fee.

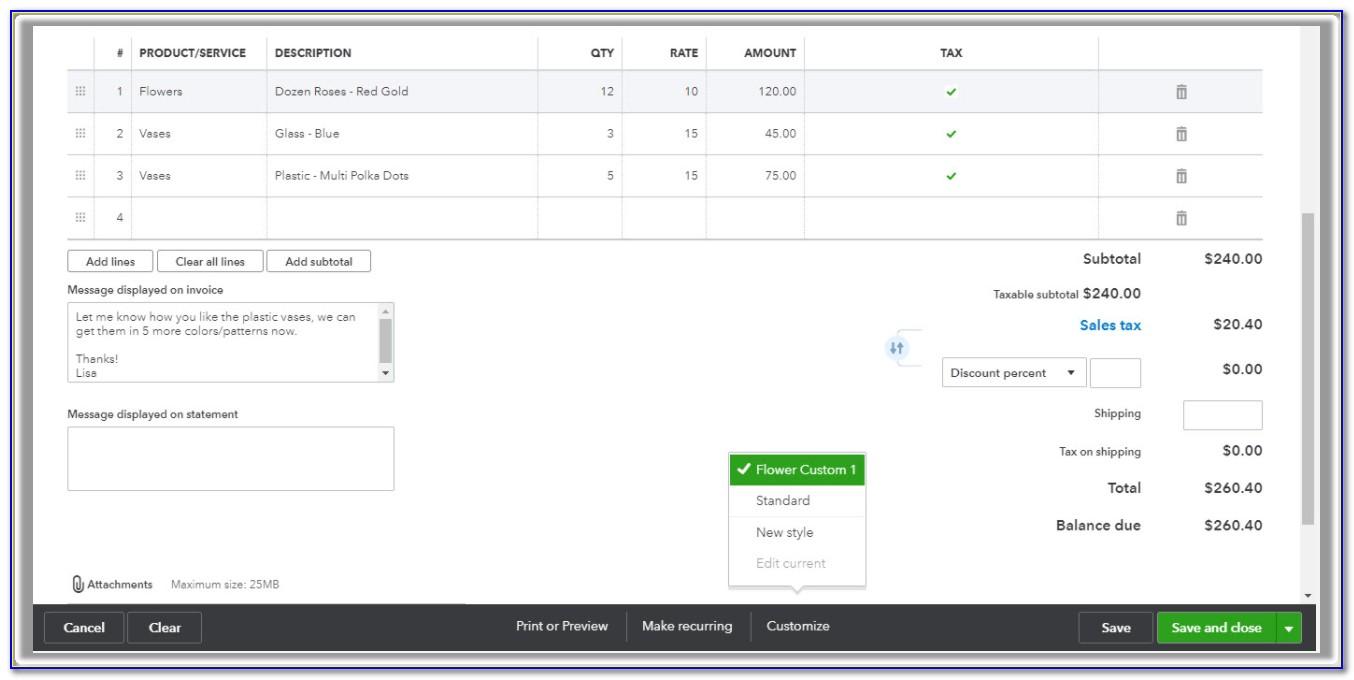

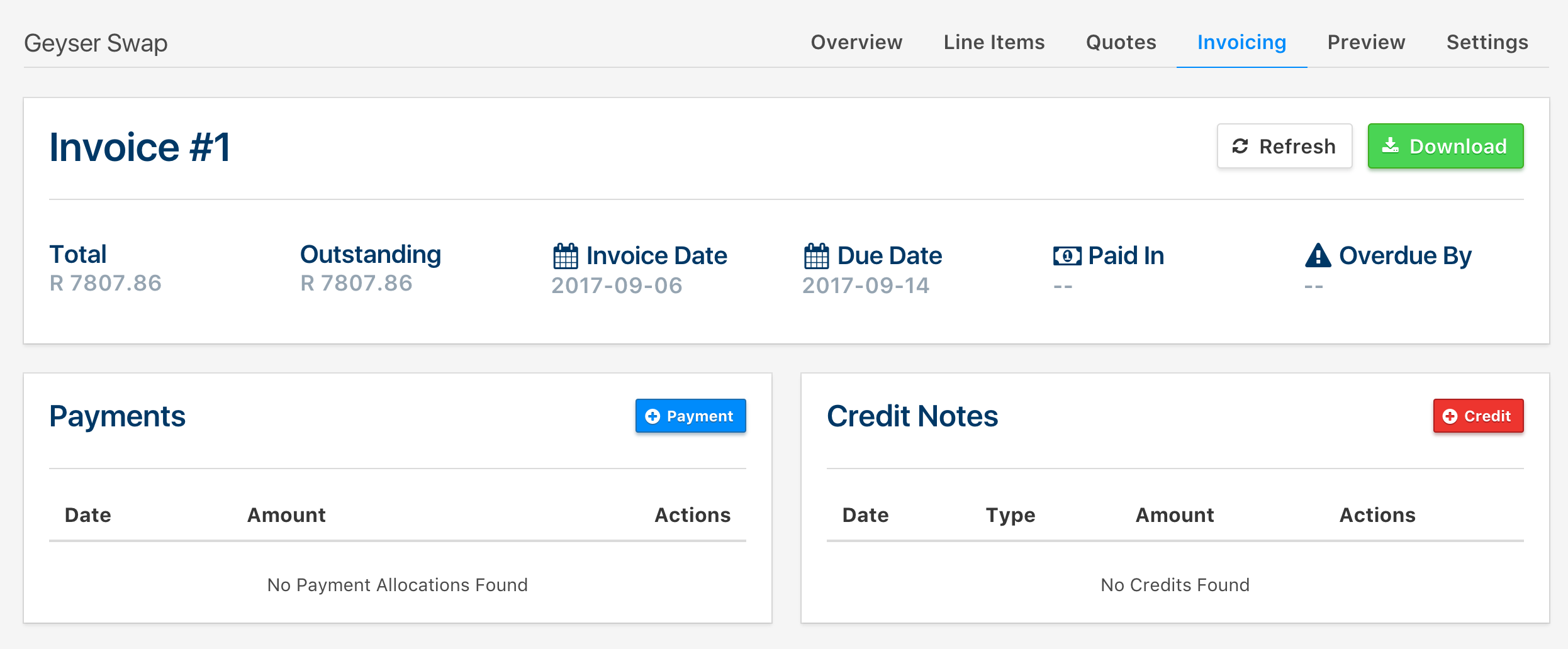

The factor rate, which is also known as factoring rate, discounting rate or discount rate, usually ranges from 1% to 5%. Factor feeįactor fee is calculated at a factor rate of the face value of factored invoices. It is a fee for processing your factoring application and opening an account for your business. Origination fee, otherwise known as draw fee, is a flat rate fee charged at a percentage of each factored invoice. You may be asked to cover the costs of credit checks. To assess the risks of non-payment, factoring companies would make credit checks on your customers before approving your application. The following table summarizes their differences to help you compare these two types of invoice factoring: Recourse and non-recourse factoring are two types of invoice factoring with a number of differences. If the factoring agreement is a non-recourse one, you are not obliged to buy back or replace the non-performing invoice.Īs the cost of customer default is absorbed by the factoring company in this case, non-recourse factoring is less common and usually comes with higher fees. Non-recourse factoring refers to an arrangement in which the factoring company buys an invoice without recourse to the seller. To this end, you may need to provide personal guarantee to repay the amount of invoice in the event of customer non-payment. Some factoring companies also allow you to replace the unpaid invoice with another receivable of equal or greater value.Īs an invoice seller may need to purchase back the invoice, factoring companies want to make sure that your company is in a good liquidity position and able to buy back. In recourse factoring, you are required to buy back an invoice if your customer fails to make payment on it. There are two types of invoice factoring: recourse factoring and non-recourse factoring. The remaining amount, which is $14,400 − 12,240 = $2,160, will be given to you only after your client settles the invoice. In other words, you will receive a total of $14,400 on this invoice.Īs an initial advance, the factoring company will give you $14,400 x 85% = $12,240 of cash upfront. The cost of capital is equal to the factor fee, which is $15,000 x 4% = $600. In this example, the invoice to be sold has a face value of $15,000. Total to be received (invoice value after fee) To put words into numbers, below is a table summarizing the above-stated factoring arrangement:Ĭ. The factor rate is 4% and initial advance is 85% of invoice value after fee. Let’s say you have an outstanding invoice worth $15,000, which you decide to sell to a factoring company. To illustrate how invoice factoring works monetarily, an example of invoice factoring is explained below. The factoring company collects payment from your customers when the invoice falls due.Īfter your client has paid on the invoice, the factoring company gives you the remainder of what it agrees to pay you. When an invoice is sold, you immediately receive an initial cash advance from the factoring company. Below is a quick guide on how invoice factoring works. In invoice factoring, the factoring company makes two payments to you at different times. Learn more: Invoice Financing: Everything You Need To Know How does invoice factoring work? (With example)

Invoice factoring is a sub-category of invoice financing.

Invoice financing refers to the use of invoices to provide capital to businesses. What is the difference between invoice factoring and invoice financing? Rather, it is an arrangement in which you sell outstanding invoices and the factoring company buys your invoices at a discount. In this way, invoice factoring helps you get cash quickly by eliminating the need to wait for your customers to pay. The factoring company will then collect money from your customers when the invoice is due. Upon buying your invoice, the factoring company will give you, in cash, a portion of the amount you are owed on the invoice. Typically, invoices are sold to third party companies specialized in invoice factoring services, each of which is called a “factor” or “factoring company”. Invoice factoring is a way for businesses to get a quick cash injection by selling invoices at a discount. To help you evaluate whether invoice factoring is a good idea for your business, this article explains what invoice factoring is, how it works, types and costs of invoice factoring, as well as its pros and cons. By selling outstanding invoices, you could get access to cash before your customers settle payment. Invoice factoring is a way for businesses to unlock money tied up in their accounts receivable.

0 kommentar(er)

0 kommentar(er)